Get Free Credit Score in India Without PAN Card:- Understanding your credit score is crucial for managing your financial health, especially when applying for loans or credit cards in India. However, many individuals face a challenge: they lack a PAN card, a document often required to check credit scores. If you’re in this situation, you’re not alone, and there are solutions available! This comprehensive guide will show you how to Get Free Credit Score in India Without PAN Card in 2025, ensuring you can monitor your credit health hassle-free. We’ll explore alternative methods, reliable platforms, and practical steps to access your credit score, even without a PAN card, while aligning with the latest trends in India’s financial landscape.

What Is a Credit Score and Why Does It Matter?

A credit score is a three-digit number, typically ranging from 300 to 900, that reflects your creditworthiness. In India, bureaus like TransUnion CIBIL, Experian, Equifax, and CRIF High Mark calculate this score based on your credit history, repayment behavior, and other financial activities. A higher score (closer to 900) increases your chances of loan or credit card approval at favorable interest rates.

Why Check Your Credit Score?

- Loan Approvals: Lenders use your score to assess your ability to repay.

- Better Interest Rates: A good score (750+) can secure lower rates.

- Financial Awareness: Regular checks help you spot errors or fraudulent activity.

- Negotiation Power: A strong score gives you leverage with lenders.

InHowever, many platforms require a PAN card for identity verification, which can be a barrier for those without one. Let’s explore how to Get Free Credit Score in India without this document.

Challenges of Checking Credit Scores Without a PAN Card

The Permanent Account Number (PAN) card is a key identifier in India, linking your financial transactions and tax records. Credit bureaus often use it to pull your credit history accurately. Without a PAN card, you might face these challenges:

- Identity Verification Issues: Most platforms require a PAN for secure access.

- Limited Access to Reports: Some bureaus restrict free reports without a PAN.

- Alternative ID Requirements: You may need other government-issued IDs, which not everyone has readily available.

Despite these hurdles, there are legitimate ways to Get Free Credit Score in India Without PAN Card, as outlined below.

How to Get Free Credit Score in India Without PAN Card

Several platforms and methods allow you to check your credit score without a PAN card by using alternative identification documents. Here’s a step-by-step guide to help you navigate this process in 2025.

1. Use Platforms That Accept Alternative IDs

Certain credit bureaus and financial service providers allow you to check your credit score using IDs other than a PAN card, such as an Aadhaar card, Voter ID, Passport, Driver’s License, or Ration Card. Here’s how:

Steps to Check via CIBIL’s Official Website

- Visit the official TransUnion CIBIL website (www.cibil.com).

- Click on “Get Your Free CIBIL Score.”

- Sign up or log in using your mobile number and email.

- Instead of a PAN card, select an alternative ID (e.g., Aadhaar, Voter ID, or Passport).

- Verify your identity using an OTP sent to your registered mobile number.

- Access your free CIBIL score and report.

Note: CIBIL offers one free score and report per year, with the next available on January 1, 2026, if you’ve already availed it in 2025.

Platforms Supporting Alternative IDs

- Buddy Loan: A user-friendly platform that allows credit score checks with Aadhaar or other IDs.

- Moneyview: Offers a seamless process to Get Free Credit Score in India using a Passport, Voter ID, or Driver’s License.

- IndiaLends: Partners with Experian and CRIF High Mark, accepting multiple IDs for free credit score checks.

2. Leverage Aadhaar-Based Verification

Your Aadhaar card, a 12-digit unique identification number, can be a powerful tool to access your credit score without a PAN card. Many platforms accept Aadhaar for identity verification due to its widespread use in India.

Steps to Check with Aadhaar

- Visit a platform like Buddy Loan or CIBIL.

- Select “Check Your Credit Score” and choose Aadhaar as your ID type.

- Enter your Aadhaar number and verify via OTP sent to your linked mobile number.

- View your credit score and download your report.

Tip: Ensure your Aadhaar is linked to your mobile number for OTP verification.

3. Use Mobile Apps with Simplified KYC

Several mobile apps in 2025 have simplified their Know Your Customer (KYC) processes, allowing users to Get Free Credit Score in India without a PAN card. Apps like Paytm, Bajaj Finserv, and IndiaLends offer this feature.

Example: Checking via Paytm

- Download the Paytm app from the Play Store or App Store.

- Navigate to the “Credit Score” section.

- Select an alternative ID (e.g., Aadhaar or Voter ID) for verification.

- Complete the OTP authentication.

- View your credit score instantly.

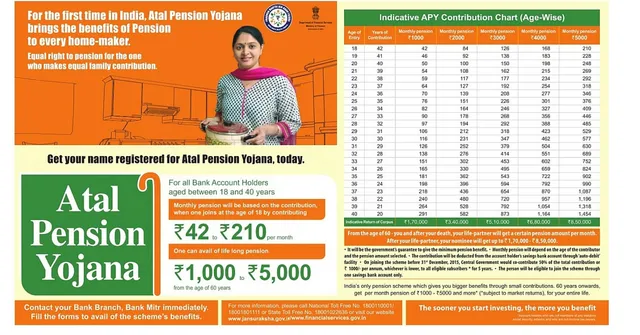

4. Opt for Secured Credit Cards to Build a Score

If you don’t have a credit score because you’ve never used credit, you can start by applying for a secured credit card, which doesn’t require a PAN card or credit history. These cards are issued against a fixed deposit (FD).

Popular Secured Credit Cards in 2025

- SBI Unnati Credit Card: Requires an FD of Rs. 25,000; no annual fee for the first four years.

- ICICI Bank Instant Platinum Credit Card: Available against an FD of Rs. 50,000.

- SBM Bank Rupicard: No credit score check, issued against an FD.

Once you start using the card and making timely payments, your credit score will be generated, which you can then check using alternative IDs.

Comparison of Platforms to Get Free Credit Score in India

| Platform | Alternative IDs Accepted | Frequency of Free Checks | Unique Feature |

|---|---|---|---|

| CIBIL | Aadhaar, Voter ID, Passport | Once per year | Detailed credit report |

| Buddy Loan | Aadhaar, Driver’s License, Ration Card | Monthly updates | User-friendly app interface |

| Paytm | Aadhaar, Voter ID | As needed (soft inquiry) | Quick access via app |

| IndiaLends | Aadhaar, Passport, Voter ID | Quarterly updates for 1 year | Partners with Experian & CRIF |

| Moneyview | Aadhaar, Driver’s License, Passport | Monthly checks | No impact on credit score |

Benefits of Checking Your Credit Score Without a PAN Card

1. Accessibility for All

Not everyone has a PAN card, especially students, low-income individuals, or those new to financial systems. Using alternative IDs ensures everyone can monitor their credit health.

2. No Impact on Score

Checking your credit score using these methods is considered a soft inquiry, meaning it won’t affect your score, unlike hard inquiries made by lenders.

3. Financial Empowerment

Knowing your credit score empowers you to make informed decisions, whether applying for a loan, negotiating interest rates, or identifying errors in your credit report.

4. Fraud Protection

Regular monitoring helps you spot unauthorized credit pulls or errors, protecting you from potential fraud.

Real-World Example: How Priya Checked Her Credit Score Without a PAN Card

Priya, a 20-year-old college student from Bengaluru, wanted to apply for a student loan but didn’t have a PAN card. She was concerned about her creditworthiness since she had never used credit before. After researching online, Priya discovered she could Get Free Credit Score in India Without PAN Card using her Aadhaar card on the Buddy Loan app. She downloaded the app, entered her Aadhaar number, and verified her identity via OTP. To her surprise, she had no credit score because she had no credit history. Following advice from the app, Priya applied for an SBI Unnati secured credit card against a fixed deposit.

After six months of responsible usage and timely payments, she checked her score again on Buddy Loan and found it had risen to 720, making her eligible for a student loan at a competitive rate. This process not only helped Priya access credit but also taught her the importance of building a healthy credit profile.

FAQ Section

1. How Can I Get Free Credit Score in India Without PAN Card in 2025?

You can Get Free Credit Score in India Without PAN Card by using alternative identification documents like an Aadhaar card, Voter ID, Passport, or Driver’s License on platforms such as TransUnion CIBIL, Buddy Loan, or Paytm. Start by visiting the official website or downloading the app of a trusted platform. For instance, on the CIBIL website, click “Get Your Free CIBIL Score,” sign up with your mobile number, and select an alternative ID for verification. After verifying your identity via OTP, you can access your score.

Apps like Buddy Loan simplify the process further by offering a user-friendly interface and monthly updates. This method ensures you can monitor your credit health without a PAN card, making financial management accessible to students, freelancers, or anyone without a PAN.

2. What Alternative IDs Can I Use to Get Free Credit Score in India?

To Get Free Credit Score in India without a PAN card, you can use several alternative government-issued IDs, including Aadhaar card, Voter ID, Passport, Driver’s License, or Ration Card. Platforms like CIBIL, Moneyview, and IndiaLends accept these IDs for identity verification. For example, on Buddy Loan, you can register with your Aadhaar number, verify it via OTP, and access your score instantly. Ensure the ID you provide is linked to your mobile number for OTP authentication. These alternatives make credit score access inclusive, especially for those who haven’t yet obtained a PAN card but need to monitor their credit health for loan or credit card applications.

3. Does Checking My Credit Score Without a PAN Card Affect My Score?

No, checking your credit score without a PAN card does not affect your score. This process is considered a soft inquiry, which has no impact on your credit score, unlike hard inquiries made by lenders when you apply for credit. Platforms like Paytm, CIBIL, and Moneyview ensure that your score remains unaffected when you Get Free Credit Score in India Without PAN Card. For instance, using your Aadhaar on the CIBIL website to check your score is a soft pull, allowing you to monitor your credit health as often as needed without worrying about a score drop. Regular checks help you stay informed and address any discrepancies in your credit report promptly.

4. What If I Don’t Have a Credit Score Yet?

If you don’t have a credit score because you’ve never used credit, you’ll see an “NA” (Not Available) or “NH” (No History) tag when you try to Get Free Credit Score in India. This is common for individuals new to credit, such as students or those who haven’t taken loans or credit cards. To build a score, apply for a secured credit card, like the SBI Unnati or ICICI Bank Instant Platinum, which doesn’t require a credit history or PAN card—just a fixed deposit. Use the card responsibly, making timely payments, and your score will start to build within 6–12 months. Once generated, you can check it using alternative IDs on platforms like IndiaLends or Buddy Loan.

5. Is It Safe to Check My Credit Score Online Without a PAN Card?

Yes, it is safe to Get Free Credit Score in India Without PAN Card online, provided you use trusted platforms like CIBIL, Paytm, or Buddy Loan. These platforms use secure encryption and OTP verification to protect your data. For example, when using Moneyview, you enter your Aadhaar or Voter ID and verify via OTP, ensuring only you can access your score. Avoid sharing personal details on unverified websites to prevent fraud. Additionally, no one can check your credit score without your authorization, adding an extra layer of security. Regularly monitoring your score on these platforms also helps you detect any unauthorized activity in your credit report.

6. Why Might Someone Not Have a PAN Card in India?

Not having a PAN card is common among certain groups in India, such as students, low-income individuals, or those new to the financial system. A PAN card is typically required for tax filings and large financial transactions, so people with minimal taxable income or no formal banking history might not have one. Additionally, some may not have applied for a PAN due to lack of awareness or because they haven’t needed it for credit purposes. For these individuals, the ability to Get Free Credit Score in India Without PAN Card using alternative IDs like Aadhaar or Voter ID is a game-changer, enabling them to participate in the credit ecosystem and build financial credibility.

Conclusion

Checking your credit score is a vital step in managing your financial health, and not having a PAN card shouldn’t stop you. With this 2025 guide, you now know how to Get Free Credit Score in India Without PAN Card using alternative IDs like Aadhaar, Voter ID, or Passport on trusted platforms such as CIBIL, Buddy Loan, and Paytm. These methods are secure, accessible, and empower you to monitor your creditworthiness without impacting your score. Whether you’re a student, freelancer, or someone new to credit, these steps can help you take control of your financial future.

Have you tried checking your credit score without a PAN card? Share your experience in the comments below, or subscribe to our newsletter for more financial tips and updates!