India is a developing country where a large number of people work in the unorganized sector. Many workers do not have any fixed income or pension after retirement. To help such people, the Government of India launched the Atal Pension Yojana (APY). This scheme is one of the most trusted social security programs for old-age citizens. It gives financial help to people after the age of 60 so they can live a peaceful and respectful life.

What is Atal Pension Yojana?

Atal Pension Yojana (APY) was started by the Government of India on 1 June 2015. The scheme was launched by the Ministry of Finance under the National Pension System (NPS). The main goal of this scheme is to provide a fixed monthly pension to workers in the unorganized sector such as farmers, laborers, drivers, maids, and shopkeepers.

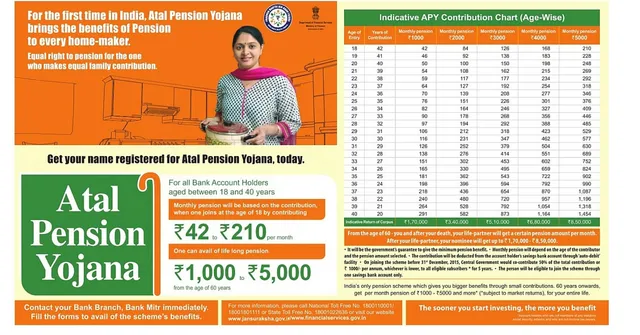

Under this scheme, people can get a monthly pension between ₹1,000 to ₹5,000 after the age of 60, depending on how much they have contributed every month. The scheme is run by the Pension Fund Regulatory and Development Authority (PFRDA).

Who Can Apply for the Scheme?

Anyone who is an Indian citizen can apply for Atal Pension Yojana if they meet the following conditions:

- The person must be between 18 and 40 years old.

- The applicant must have a savings account in a bank or post office.

- The person should not be a member of any other social security scheme like EPF or NPS.

- The applicant’s Aadhaar card and mobile number should be linked to their bank account.

Once enrolled, the person has to contribute a fixed amount every month till the age of 60. After that, he or she starts receiving a pension.

How Does the Scheme Work?

The working process of the Atal Pension Yojana is very simple. When a person joins the scheme, he or she chooses how much pension they want to get after 60 years — ₹1,000, ₹2,000, ₹3,000, ₹4,000, or ₹5,000 per month.

Based on that choice, the person will have to deposit a fixed amount every month. The earlier you start, the less amount you need to pay monthly.

For example:

- If you are 18 years old and choose a pension of ₹5,000, you will need to pay only ₹210 per month.

- But if you are 35 years old, for the same ₹5,000 pension, you will have to pay around ₹543 per month.

After the age of 60, the subscriber starts receiving the fixed monthly pension.

If the subscriber dies, then the spouse (husband or wife) will continue to receive the pension. After both die, the nominee (for example, son or daughter) gets the total pension amount saved in the account.

Benefits of Atal Pension Yojana

The Atal Pension Yojana offers many benefits, especially for people with low income:

- Guaranteed Pension: After the age of 60, the subscriber gets a fixed pension every month.

- Family Security: If the subscriber dies, the spouse will continue to receive the pension.

- Low Contribution: The monthly contribution is very small and affordable for poor and middle-class people.

- Tax Benefits: The amount paid under APY is eligible for tax deduction under Section 80CCD(1) of the Income Tax Act.

- Government Support: Earlier, the government also contributed 50% of the total contribution or ₹1,000 per year (whichever is less) for those who joined before 31 December 2015.

- Safe and Reliable: The scheme is fully backed by the Government of India, which makes it one of the safest pension schemes in the country.

How to Apply for Atal Pension Yojana

The process to apply for APY is very easy and simple:

- Visit your nearest bank or post office where you have a savings account.

- Fill out the Atal Pension Yojana form (available in Hindi, English, and regional languages).

- Provide your Aadhaar card and mobile number.

- Choose your pension amount and agree to the auto-debit facility (the monthly amount will be automatically deducted from your account).

- Submit the form and your registration will be completed.

You will receive a confirmation message on your registered mobile number once your account is activated.

Important Points to Remember

- You can exit from the scheme only in case of death or terminal illness before 60 years.

- Regular contributions must be made; if you miss payments, penalties will apply.

- You can check your APY balance and status online through your bank’s net banking or the PFRDA website.

- You can also update your nominee, address, or contact details easily at your bank branch.

Conclusion

The Atal Pension Yojana is one of the best and most trusted schemes for old-age financial security in India. It ensures that people from the unorganized sector — like daily wage workers, small traders, and domestic helpers — do not have to depend on others in their old age.

With small monthly savings, they can secure their future and live a life of dignity and independence after retirement. This scheme truly fulfills the dream of “Sabka Saath, Sabka Vikas” by giving financial safety to every hardworking citizen of India.