Saving money safely and earning good returns is important, especially for senior citizens. Fixed Deposits (FDs) are one of the most trusted and popular ways for them to invest their money. Many banks in India are now offering higher interest rates on FDs for senior citizens — some even above 7% per year. Let’s take a closer look at which banks are offering these high rates, what the benefits are, and what you should know before investing.

What Are Fixed Deposits (FDs)?

A Fixed Deposit (FD) is a savings option offered by banks where you deposit a certain amount of money for a fixed period — such as 1 year, 3 years, or 5 years — and earn interest on it. The interest rate is fixed when you open the FD and does not change until maturity.

For senior citizens (60 years and above), banks generally offer an extra 0.25% to 0.75% higher interest compared to normal customers. This helps retired people earn more from their savings.

Why Senior Citizens Prefer FDs

Senior citizens often prefer FDs because:

- They are safe and stable – returns are guaranteed.

- They provide regular income through monthly or quarterly interest payouts.

- They are easy to manage and can be opened online or offline.

- They come with tax benefits under Section 80C for certain tenures.

Now, let’s see which banks in India are offering more than 7% interest on fixed deposits for senior citizens.

1. State Bank of India (SBI)

- Interest Rate for Senior Citizens: Up to 7.50% per annum

- Tenure: 7 days to 10 years

SBI, India’s largest bank, gives senior citizens an extra 0.50% interest on top of regular FD rates. For the special SBI “Amrit Kalash” scheme, the rate goes up to 7.60% for a 400-day FD. - Minimum Deposit: ₹1,000

- Maximum Deposit: No upper limit

- Premature Withdrawal: Allowed with penalty

2. HDFC Bank

- Interest Rate for Senior Citizens: Up to 7.75% per annum

- Tenure: 7 days to 10 years

HDFC Bank is known for its reliable service and attractive FD rates. The highest interest rate of 7.75% is available for deposits between 18 months and 35 months. - Minimum Deposit: ₹5,000

- Special Feature: Senior citizens get 0.75% more than general customers.

3. ICICI Bank

- Interest Rate for Senior Citizens: Up to 7.75% per annum

- Tenure: 7 days to 10 years

ICICI Bank offers senior citizens a bonus interest of 0.50% above the standard rates. The best returns are on FDs between 15 months and 2 years. - Minimum Deposit: ₹10,000

- Online FD facility available

4. Axis Bank

- Interest Rate for Senior Citizens: Up to 7.75% per annum

- Tenure: 6 months to 10 years

Axis Bank provides one of the highest FD rates for senior citizens, touching 7.75% for select tenures. - Minimum Deposit: ₹5,000

- Extra Benefit: Senior citizens get 0.75% higher interest.

5. Punjab National Bank (PNB)

- Interest Rate for Senior Citizens: Up to 7.80% per annum

- Tenure: 1 year to 10 years

PNB’s FD scheme for senior citizens offers solid returns and flexibility. The highest rate applies to the “666 days” special deposit scheme. - Minimum Deposit: ₹1,000

- Premature Closure: Allowed after certain terms.

6. IDFC FIRST Bank

- Interest Rate for Senior Citizens: Up to 8.25% per annum

- Tenure: 1 year to 5 years

IDFC FIRST Bank offers some of the highest FD rates in the country. For senior citizens, the rate can reach 8.25% for 500-day FDs. - Minimum Deposit: ₹10,000

- Additional Benefit: Interest can be paid monthly, quarterly, or on maturity.

7. IndusInd Bank

- Interest Rate for Senior Citizens: Up to 8.00% per annum

- Tenure: 1 year to 3 years

IndusInd Bank’s FDs are ideal for those seeking high short-term returns. - Minimum Deposit: ₹10,000

- Payout Options: Monthly, quarterly, or at maturity

8. Yes Bank

- Interest Rate for Senior Citizens: Up to 8.00% per annum

- Tenure: 1 year to 3 years

Yes Bank offers competitive FD rates, making it an attractive choice for senior investors. - Minimum Deposit: ₹10,000

- Interest Payment Options: Monthly, quarterly, or annual

Comparison Summary

| Bank Name | Max Interest Rate (Senior Citizens) | Best Tenure |

|---|---|---|

| IDFC FIRST Bank | 8.25% | 500 days |

| IndusInd Bank | 8.00% | 1–3 years |

| Yes Bank | 8.00% | 1–3 years |

| PNB | 7.80% | 666 days |

| HDFC Bank | 7.75% | 18–35 months |

| ICICI Bank | 7.75% | 15–24 months |

| Axis Bank | 7.75% | 1–2 years |

| SBI | 7.50% | 400 days |

Important Things to Remember

- Interest rates may change — always check the latest rate before investing.

- Tax on FD interest: FD interest is taxable under “Income from Other Sources.”

- Premature withdrawal penalty: If you break your FD early, you may lose some interest.

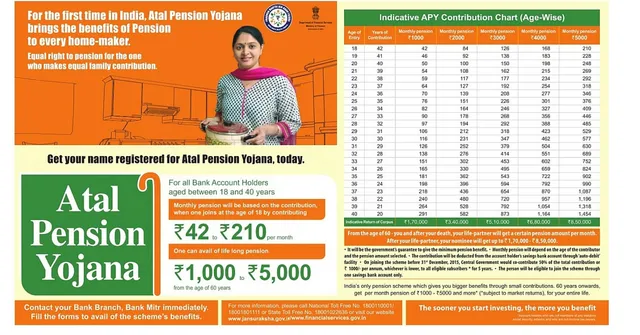

- Senior Citizen Schemes: You can also consider the Senior Citizen Savings Scheme (SCSS), which currently offers around 8.2% interest per year with government backing.

Final Thoughts

For senior citizens, Fixed Deposits remain one of the safest and easiest investment options in 2025. With several banks offering more than 7% interest, it’s a good time to lock in these rates. Banks like IDFC FIRST, IndusInd, Yes Bank, and PNB are offering some of the best deals currently.

Before investing, senior citizens should compare rates, choose suitable tenures, and decide whether they want monthly income or a lump sum at maturity. A well-planned FD portfolio can ensure financial security and steady income during retirement.